Wealth insurance

Don’t let the taxman decide your legacy

Your wealth is more than just a symbol of your hard work and success—it's the legacy you’ll pass on. At WealthCo, we understand the importance of not only preserving this legacy but also maximizing its impact.

Your financial future shouldn't be stressful

Realize your vision

Maximize your impact

Leave a lasting legacy

Preserve and pass on your wealth with tax efficient estate planning

We specialize in the advanced application of insurance based tax solutions to help protect your wealth from excessive tax, guiding it towards the people and causes you cherish.

By strategically planning your estate, using practical tools such as life insurance, we ensure your legacy truly reflects your vision, not the dictates of the tax code.

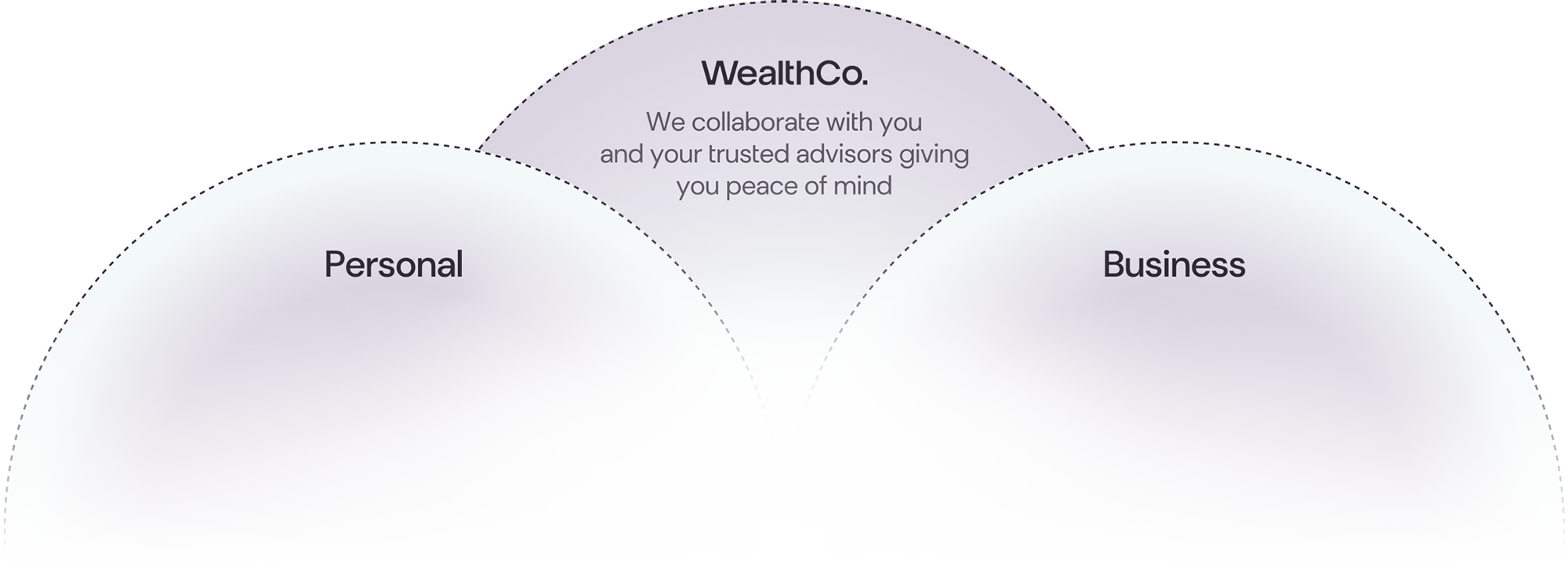

See the full picture of your estate plan

An integrated financial team is essential when approaching the complexities of estate planning.

Collaborate with the team you trust

We advocate for collaboration among your advisors and trusted sources to craft an estate plan that mirrors your vision and wishes.

Bringing simplicity to your estate plan

We are dedicated to making your life simpler, by taking the burden of planning, forecasting, investing, and risk management off your plate.

Leave a lasting legacy

Maximum your impact and worry less about the legacy you’ll leave behind, and focus more on the impact you can make today.

The 4 pillars of leaving your mark

Whether you’re exiting your business, planning on succession within the family, or simply want to leave an inheritance for your children and grandchildren, there are four core areas of estate planning that we focus on to ensure that you realize the vision for your estate, maximize your impact, and leave your mark.

01 / 04

01 / 04

Tax planning

Effective tax strategies can significantly reduce the burden of taxes on your estate, ensuring that more of your wealth goes to people and causes you care about most. Without thorough tax planning, significant wealth can be eroded in the transfer process, impacting the legacy you leave behind.

We work with you accountant and integrated team to ensure that the insurance strategies that we use fit into your integrated financial plan.

02 / 04

02 / 04

Estate preservation

Estate preservation is about safeguarding your wealth not just for your lifetime, but for generations to come.

With prudent management and strategic planning, estate preservation protects your assets from undue losses, legal complications, and unnecessary taxes. It ensures that your wealth remains intact and continues to grow even as it's passed on.

03 / 04

03 / 04

Succession planning

Succession planning is not just about who inherits what, but also how your legacy unfolds over time, maintaining harmony and stability amidst change. More than just a distribution of wealth, it's a roadmap for the future that mitigates disputes and ensures the continuity of your legacy. Without thoughtful succession planning, your estate could face unnecessary turmoil or disruption.

04 / 04

04 / 04

Philanthropy

Beyond wealth distribution to heirs, integrating philanthropy into your estate plan allows you to leave a lasting legacy to causes you deeply care about. Whether through charitable trusts, foundations, or direct donations, philanthropic planning can also provide substantial tax benefits, making it not just an act of goodwill but also a strategic financial decision. It's about leveraging your wealth to effect positive change and turn it into a force for good.

Experience the

WealthCo advantage

Experience the unmatched advantage of having an integrated team working to help realize your vision for your legacy.

-

Enjoy the ease of coordination between all your financial activities and advisors for a cohesive estate plan.

-

Navigate the complexities of estate planning with our team of specialists and experts at your side.

-

Benefit from personalized strategies that align with your unique goals and the legacy you envision.

-

Rest easy knowing your wealth will serve your vision, supporting your loved ones and cherished causes.

Don’t let your legacy be eroded by expensive capital gains tax

Estate planning is more than just a wealth transfer; it's about creating a lasting legacy that aligns with your values and aspirations. At WealthCo, we understand that your legacy should be shaped by your vision, not the tax act or legal complexities. We provide expert guidance, tailored strategies, seamless coordination, and assurance that your estate will serve your intended purpose.

Our team of experienced professionals is committed to helping you navigate the often daunting terrain of estate planning. With our personalized approach, we help you steer clear of potential pitfalls, ensure maximum preservation of your estate, and craft a roadmap for a smooth succession. We also integrate philanthropy into your estate plan, transforming your wealth into a force for good that echoes beyond your lifetime.

We're here to help you leave a meaningful and enduring legacy. Experience the WealthCo advantage, where estate planning becomes less about the transfer of wealth and more about the seamless continuation of your vision.

FAQ

-

You may have had a negative experience in the past that was created by an inexperienced advisor that simply sold you something. We operate differently. We use the information you provide to project your financial future using conservative assumptions. If there is a gap, we'll find ways to fill it using conventional products that don't involve insurance. However, if insurance seems to be the most efficient way to solve a problem, we'll demonstrate to you why it is, and how it makes more sense than the alternatives. We'll never sell you anything - we leave you in the drivers seat to make all of the decisions.

-

Your arrangement/contract is not with WealthCo., it is with one of the strongest life insurance companies in the world. In the event I'm not here, or WealthCo. isn't here, you don't have to worry. The insurers we work with have been in business for over 100 years and manage hundreds of billions - if not trillions - of dollars. They are strong, highly rated and Canadian. And you have a direct line to contact them outside of WealthCo.

-

The insurers we work with are flexible and their contracts are designed to work with you through the different stages of your life. We will assist you in negotiating any changes that may arise.

-

Our high-end insurance solutions provide tailored coverage to protect your wealth, business, and family from unforeseen events, ensuring financial security and peace of mind.