Modern wealth management for

Successful

business owners

Simplifying your financial life with integrated planning, investing, risk management, and estate planning solutions.

Helping aging parents

Saving for retirement

Buying a house

Getting married

Managing cash flow

Insurance planning

Helping aging parents Saving for retirement Buying a house Getting married Managing cash flow Insurance planning

We focus on your finances

you focus on what matters to you

Simplifying your financial life with integrated planning, investing, risk management, and estate planning solutions.

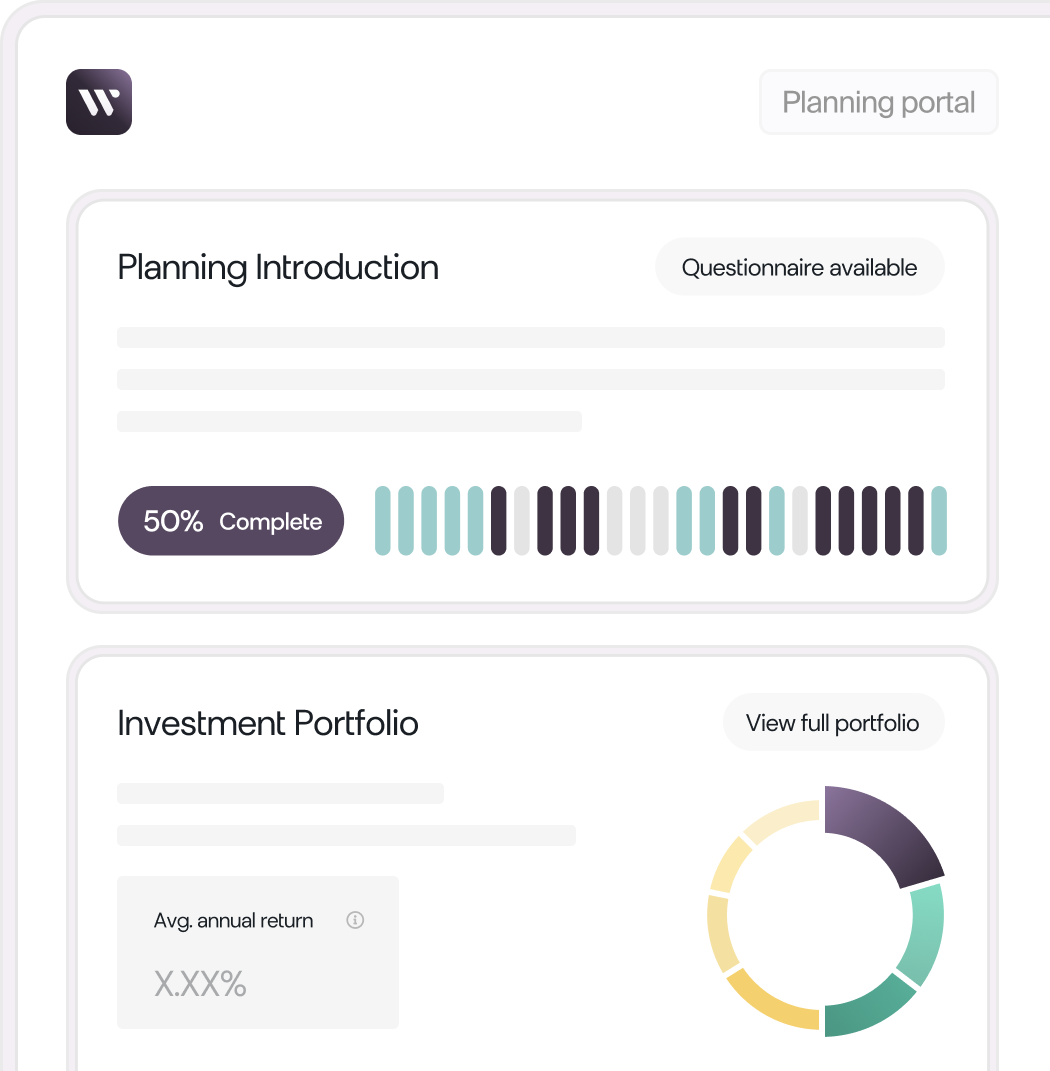

How WealthCo can help

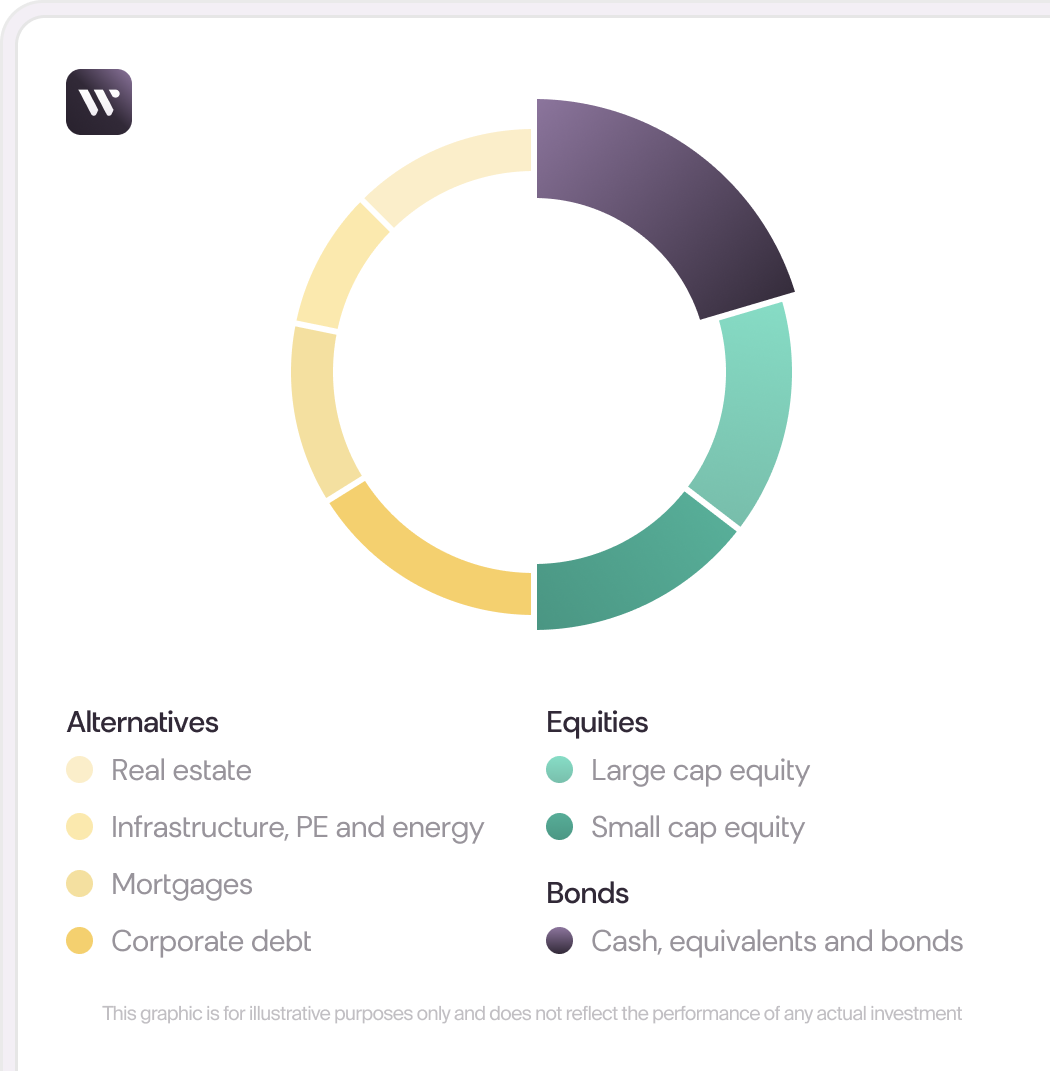

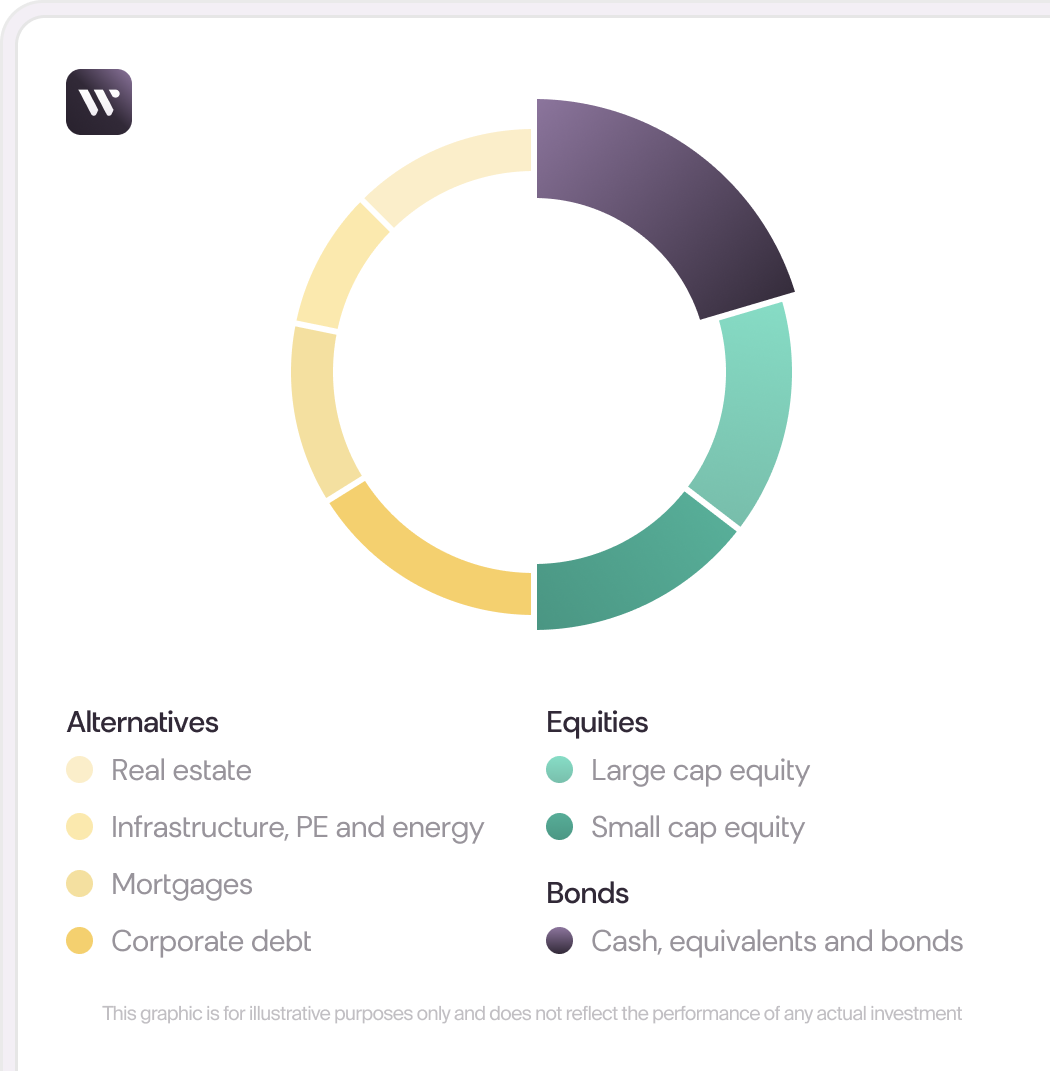

Diversify among

institutional grade assets

We craft institutional-grade portfolios blending public and private investments in real estate, VC, and fixed income. Our tax-efficient strategies and dynamic rebalancing ensure optimal performance.

Meet with us

Protect your family

protect your wealth

We help you safeguard your financial future with a range of tailored insurance solutions designed to protect you and your loved ones. WealthCo’s insurance services include life insurance, disability insurance, critical illness coverage, and more, to ensure comprehensive protection against life’s uncertainties.

WealthCo Risk Management has access to the industry’s top insurance providers, giving your peace of mind that you and your family receive the best coverage possible, for the best possible price.

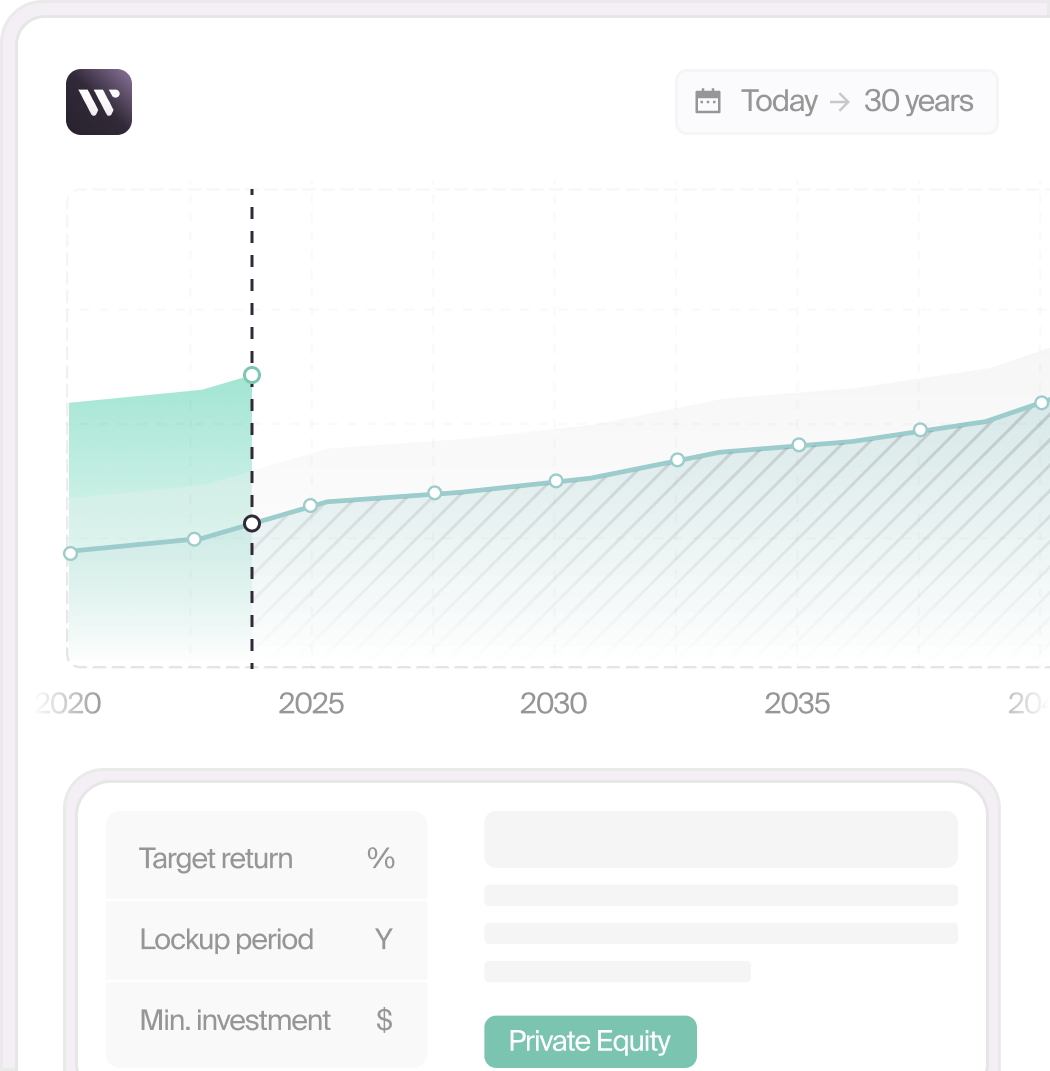

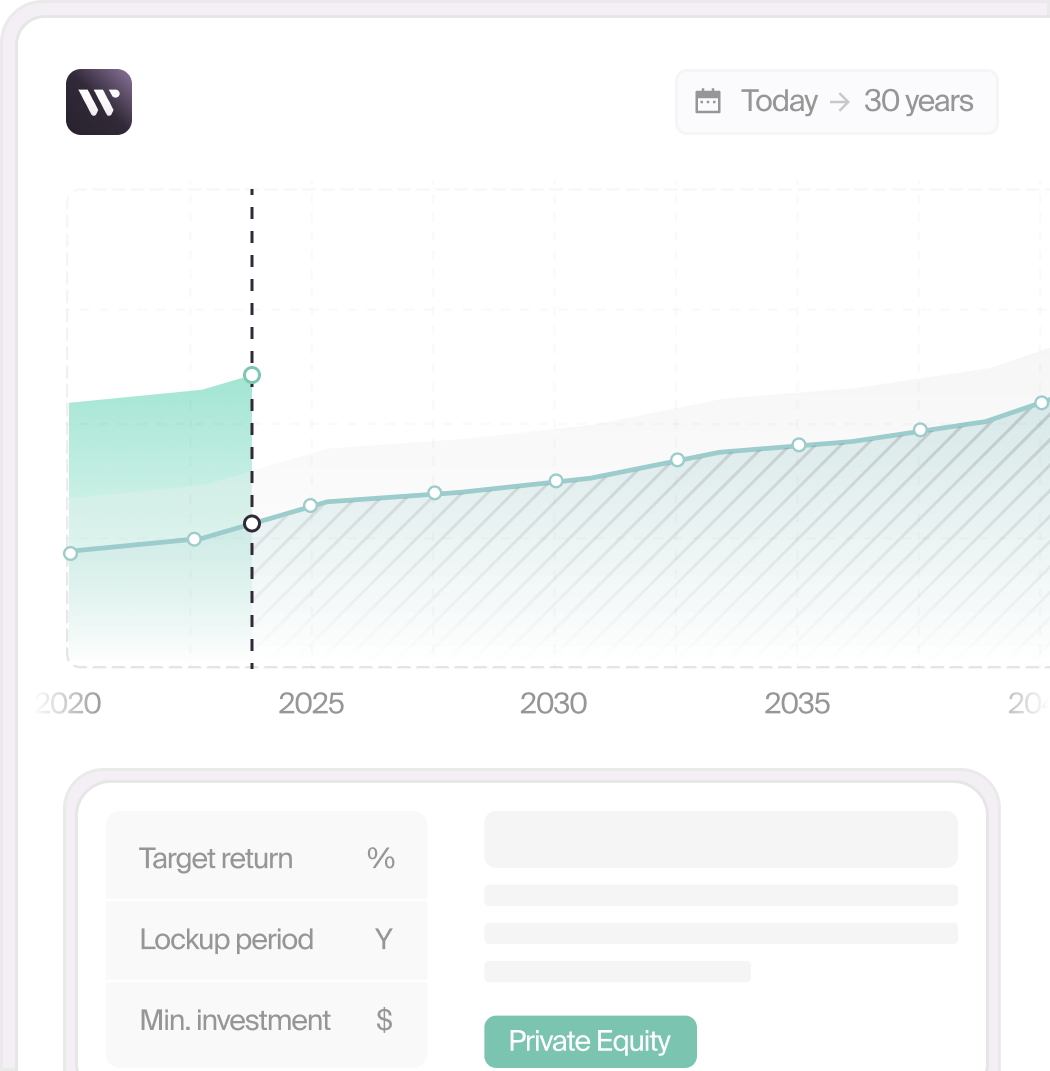

Plan for retirement

on your terms

You get to determine what your retirement looks like, we can help you make it a reality, with strategic and personalized retirement planning. Whether you plan to continue working on your business part time, or travel the world, planning for the retirement you envision is simple and worry free with our Certified Financial Planners.

With our in-house integrated wealth solutions, not only can we help you plan for retirement, we can also help you get there.

Have a question,

challenge, or opportunity?

No matter how complicated or big your problem may seem, our experienced and talented team of advisors can help. And if you ever need an ad-hoc request, such as a transfer of funds, or need to bounce an opportunity off one of our Advisors, just email us and we’ll take care of it.

Our service team has worked in the largest banks, insurance companies, and investment firms in Canada, and with our membership in the Integrated Advisory Professionals Network, if we don’t have the answer, we know someone who will. Whatever you need, we can help.

Have a question,

challenge, or opportunity?

No matter how complicated or big your problem may seem, our experienced and talented team of advisors can help. And if you ever need an ad-hoc request, such as a transfer of funds, or need to bounce an opportunity off one of our Advisors, just email us and we’ll take care of it.

Our service team has worked in the largest banks, insurance companies, and investment firms in Canada, and with our membership in the Integrated Advisory Professionals Network, if we don’t have the answer, we know someone who will. Whatever you need, we can help.

Have a question,

challenge, or opportunity?

No matter how complicated or big your problem may seem, our experienced and talented team of advisors can help. And if you ever need an ad-hoc request, such as a transfer of funds, or need to bounce an opportunity off one of our Advisors, just email us and we’ll take care of it.

Our service team has worked in the largest banks, insurance companies, and investment firms in Canada, and with our membership in the Integrated Advisory Professionals Network, if we don’t have the answer, we know someone who will. Whatever you need, we can help.

Bespoke private

wealth solutions

We help simplify the complexities of your financial world so you can enjoy the life you’ve worked so hard to build. WealthCo’s private wealth services include private wealth management and planning, customized ricks management, advanced tax planning, business and exit planning, and retirement and legacy planning, providing you with a comprehensive approach to your financial success.

WealthCo Private Wealth services and added value is provided at no additional cost, for high-net- worth clients, ensuring that your wealth works harder for you, not the other way around.

Diversify among

institutional grade assets

We craft institutional-grade portfolios blending public and private investments in real estate, venture capital, and fixed income. Our tax-efficient strategies and dynamic rebalancing ensure optimal performance.

Partnering with top sub-advisors, WealthCo Asset Management delivers expertise akin to major institutions like the Canadian Pension Fund and leading insurance companies.

Protect your family

protect your wealth

We help you safeguard your financial future with a range of tailored insurance solutions designed to protect you and your loved ones. WealthCo’s insurance services include life insurance, disability insurance, critical illness coverage, and more, to ensure comprehensive protection against life’s uncertainties.

WealthCo Risk Management has access to the industry’s top insurance providers, giving your peace of mind that you and your family receive the best coverage possible, for the best possible price.

Plan for retirement

on your terms

You get to determine what your retirement looks like, we can help you make it a reality, with strategic and personalized retirement planning. Whether you plan to continue working on your business part time, or travel the world, planning for the retirement you envision is simple and worry free with our Certified Financial Planners.

With our in-house integrated wealth solutions, not only can we help you plan for retirement, we can also help you get there.

Have a question,

challenge, or opportunity?

No matter how complicated or big your problem may seem, our experienced and talented team of advisors can help. And if you ever need an ad-hoc request, such as a transfer of funds, or need to bounce an opportunity off one of our Advisors, just email us and we’ll take care of it.

Our service team has worked in the largest banks, insurance companies, and investment firms in Canada, and with our membership in the Integrated Advisory Professionals Network, if we don’t have the answer, we know someone who will. Whatever you need, we can help.

Bespoke private

wealth solutions

We help simplify the complexities of your financial world so you can enjoy the life you’ve worked so hard to build. WealthCo’s private wealth services include private wealth management and planning, customized ricks management, advanced tax planning, business and exit planning, and retirement and legacy planning, providing you with a comprehensive approach to your financial success.

WealthCo Private Wealth services and added value is provided at no additional cost, for high-net- worth clients, ensuring that your wealth works harder for you, not the other way around.

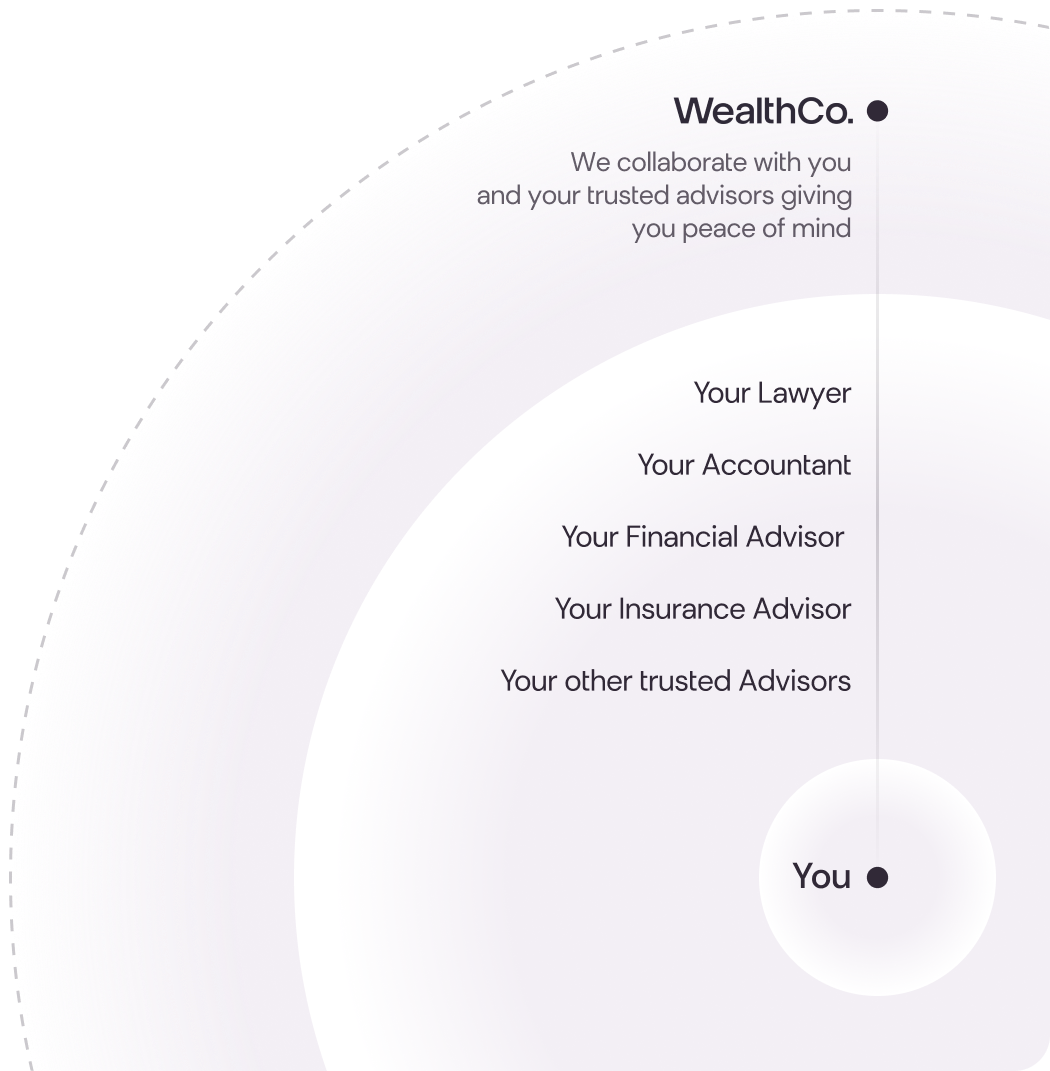

Integrated planning with

business, family, and advisors

We help you create a robust financial plan, integrating advanced strategies to secure and grow your wealth. Our planning services include retirement planning, tax optimization, and estate planning, ensuring a well-rounded approach to your financial future.

WealthCo features an in-house team of Certified Financial Planners (CFPs), investment councillors, and estate planning professionals, providing you with the same level of expertise and diligence as top-tier financial institutions, with a personal touch.

Leave a legacy

you’re proud of

We help you secure your legacy with personalized estate planning strategies designed to protect and distribute your assets according to your wishes. Working with your team of advisors, we help you navigate wills, trusts, tax-efficient strategies, and asset protection, ensuring your wealth is preserved for future generations.

Through our membership in the Integrated Advisory Professionals Network, you get access to Canada’s top estate planning advisors, so you can be confident that your legacy is in good hands.

How to get started

Easy to get started

1

We’ll help you build an endowment-quality portfolio containing public investments and private opportunities across real estate.

2

We’ll help you build an endowment-quality portfolio containing public investments and private opportunities across real estate.

3

We’ll help you build an endowment-quality portfolio containing public investments and private opportunities across real estate.

Choose WealthCo to help

Invest in the future.

Protect your family.

Plan for retirement.

Plan your estate.

If you’re ready to bring clarity and simplicity to your financial life, book a free introduction meeting with one of our team members today.

We are a fiduciary

WealthCo is an Alberta Securities Commision (ASC)-registered Investment Adviser and an independent fiduciary. Meaning we have an obligation to act in our client’s best interest. We are also required to disclose and seek to eliminate or mitigate any conflicts with any of our services.

Some of our trusted sub-advisors

FAQ

-

WealthCo helps entrepreneurs, professionals, retirees, and families achieve their financial goals. You can think of us as your family office — a single place to manage your taxes, investments, and borrowing. We support your goals and help you make better financial decisions.

-

Description text goes here

-

Description text goes here

-

Item description

-

Item description

Compare

How WealthCo stacks up

| WealthCo | Traditional firm | |

|---|---|---|

| Sample text |

|

Y |

| Sample text | ||

| Sample text | ||

| Sample text | ||

| Sample text |

Wealth management for busy professionals

We focus on your finances

We focus on your finances

you focus on what matters to you

Simplifying your financial life with integrated planning, investing, risk management, and estate planning solutions.

We focus on your finances

you focus on what matters to you

Simplifying your financial life with integrated planning, investing, risk management, and estate planning solutions.

Investing Planning Taxes Insurance Retirement Estate planning More

Testimonials

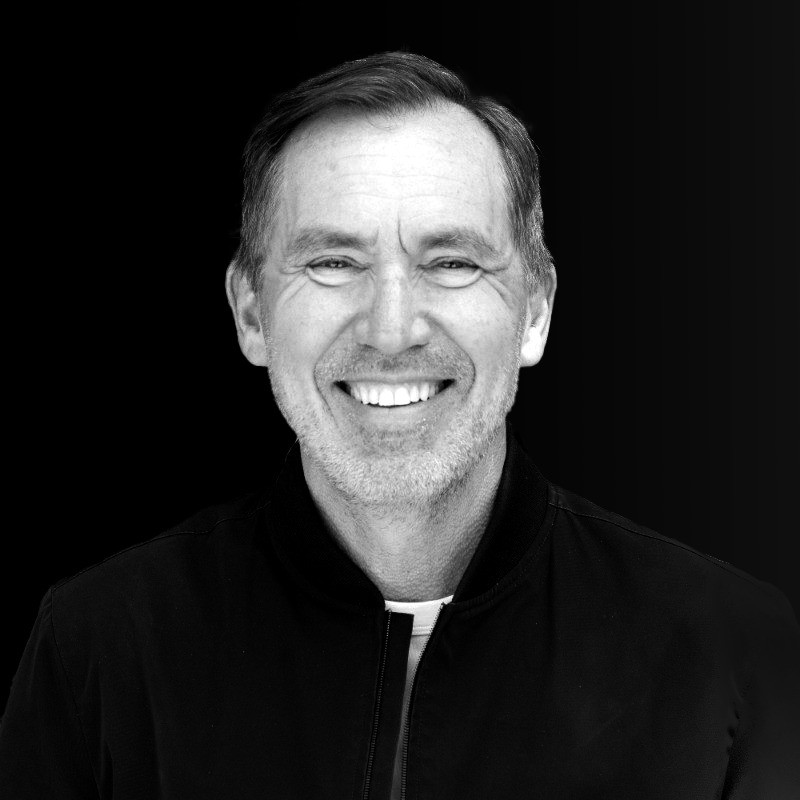

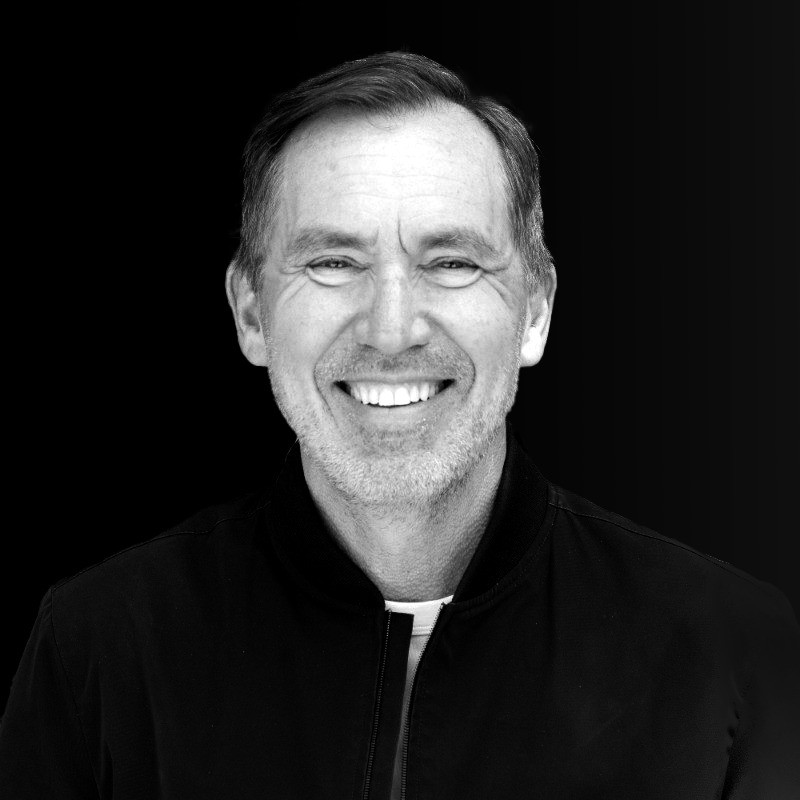

I was nervous and perhaps a little scared at first. The team followed the financial plan that was put in place after our first meetings to determine my risk tolerance and there has been no looking back. I have complete confidence in their decisions.

Gregory Shove

CEO, Section

You’ve spent decades working so you can retire comfortably

But with your retirement years approaching, you don't feel completely prepared

You know you need to start planning, but it’s hard to find the right resources and guidance that you can trust.

Build a brighter financial future for your family

Simplifying your financial life with integrated planning, investing, estate planning and risk management solutions.

Are you ready to write the next chapter of your financial future?

Are you asking yourself any of the following questions? If so, we can help.

Do I have enough saved to retire?

How can I leave a lasting legacy for children, and grandchildren?

Are my personal investments too risky?

I need a financial plan, but where do I start?

Are you concerned your missing out on tax savings?

An integrated team working for you

Collaboration

Collaboration

We believe in collaboration between your accountant and other professionals to help you achieve your personal and business goals.

Simplicity

Simplicity

We are dedicated to making your life simpler, by taking the burden of planning, forecasting, investing, and risk management off your plate.

Worry free

Worry free

Stop stressing about managing your entire financial life on your own and start enjoying more time with the people and things your love most.

Our process

Our process

A proven process designed for peace of mind

Fully managed approach designed to scale dynamically with you lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do.

1

Discover

We start by uncover what matters most to you and getting clarity on where you want to be financially, personally and professionally.

2

Advise

With a clear understanding of what you want to achieve we offer sound advice and outline a path forward that aligns with your priorities.

3

Implement

Our team of specialists implement the agreed upon advice given and together we measure, track, and adjust your plan as needed.

4

Review

We remain present and active as your life evolves with regular review meetings to keep your plan up to date and things change.

The Integrated Advisory Experience

WealthCo is a proud member of the Integrated Advisory Professionals Network

Why we're different

More than just

an investment firm

Integrated financial planning

A plan is only as good as the implementation of that plan

Ongoing integrated planning evolves as your life evolves. We work with you to build a flexible financial strategy that meets your unique needs, goals, and aspirations.

Learn more

Pension style asset management

60%/40% styles are no longer considered diversified

WealthCo’s pension style investment approach boosts your portfolios diversification, minimizes volatility, and offers a competitive return.

Learn more

Risk management and estate planning

Your most important asset is you, protect it

We take a transparent and strategic approach to insurance. You and the ones you love deserve the right protection from the unplanned and unexpected.

Learn more

A collaborative approach

A siloed financial planning approach doesn't work

We work hard to not only collaborate with you, but your existing financial team to ensure that all parts of your financial life are working together.

Learn more

Testimonials

“I was nervous and perhaps a little scared at first. The team followed the financial plan that was put in place after our first meetings to determine my risk tolerance and there has been no looking back. I have complete confidence in their decisions.”

Gregory Shove

CEO, Section

Insights

Explore

our insights

Monthly wealth-building insights delivered right to your inbox.