See how business owners are simplifying their investment strategy for a smoother ride.

WealthCo’s investment approach uses proven alternative strategies, used by the CPP, to smooth out your investment ride. Let us help you navigate a more stable path to your financial goals.

Some of our trusted sub-advisors

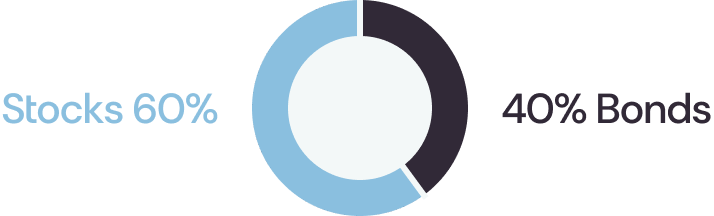

Outgrown the 60/40 portfolio?

In today's rapidly changing market, the age-old 60% stocks and 40% bonds strategy no longer suffices as optimal diversification.

As an example in 2022, both stocks and bonds declined by over 10%, leaving investors in a traditional 60/40 portfolio feeling the pain of a market correction.

Next-level diversification

Experience the institutional advantage

Large institutional investors like pension funds have largely outperformed traditional investing. Why?

They've leveraged alternative investments.

WealthCo Asset Management embraces this pension-style approach to provide our clients with unique growth potential and an extra layer of diversification beyond the traditional asset classes.

Our record

of stability

WealthCo Asset Management vs the marketplace

WealthCo | 7.0%*

Benchmark | 6.0%*

*Annualized Return (Since Inception)

Note: Based on monthly performance of WealthCo’s pooled funds (June 2014) assuming daily reblanacing. Legacy Balanced model prior to 2022.

*The historic returns and their relative performance shown herein may not be indicative of future returns. Past performance is not indicative of future results. Performance cannot be guaranteed.